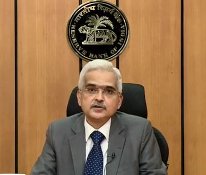

Mumbai: The RBI governor, Shaktikanta Das, Friday announced a slew of measures to revive the financial position of the country, which has badly bit by the Covid-19 pandemic.

Das has reduced the repo rate by 40 point basis to 4% making loans cheaper and reduced the EMI burden. Earlier, the RBI had reduced the reverse repo rate to 3.35%.

The RBI governor, which stating that the decision was taken at an off-cycle meeting of the Monetary Policy Committee (MPC) to cut repo rate to support growth, said that the loan moratorium has also been extended by another three months from 1stJune to 31st August, 2020

Addressing a press conference on Friday, RBI Governor Shaktikanta Das said that the country’s GDP growth rate for the financial year 2020-21 is likely to be in the negative territory due to the severe impact of the Covid-19 pandemic.

“High frequency indicators points to collapse in demand in March,” the Governor said.

However, he showed faith and confidence on the resilience of the Indian economy. Some pick-up in growth impulses is expected in second half of the year, according to Das.

Off late, several banks and rating agencies have forecast a drastic fall in India’s GDP growth rate.

He observed that investment demand has virtually come to a halt but added that agriculture and allied activities are a beacon of hope.

He also said that inflation outlook has become complicated due to incomplete data. The headline inflation will remain firm in the first half of H1 of FY21.